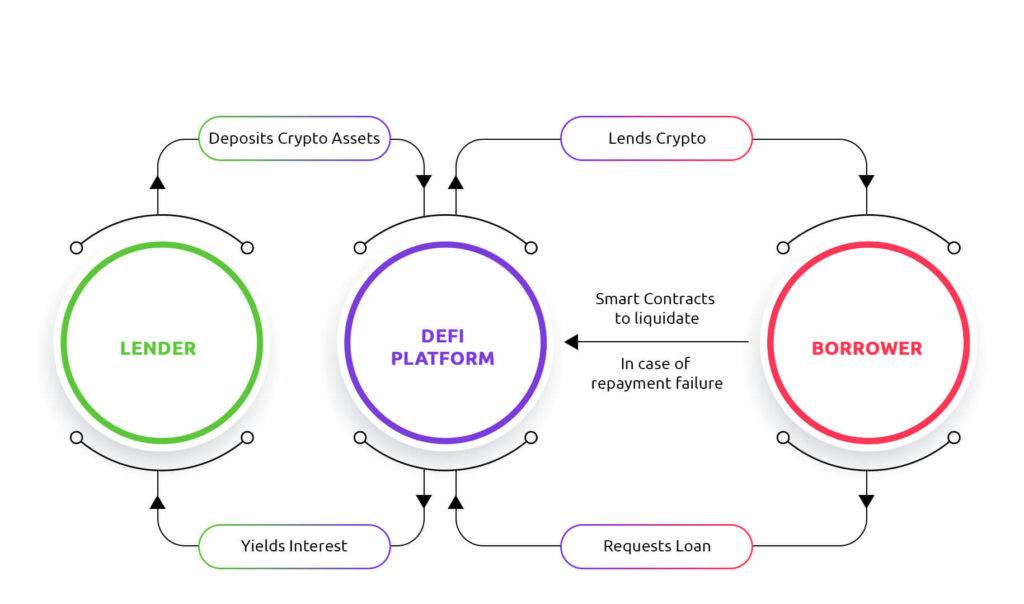

Borrowing and lending are among the most common use cases for DeFi applications, but there are many more increasingly complex options too, such as becoming a liquidity provider to a decentralized exchange. Through DeFi lending, users can lend out cryptocurrency, like a traditional bank does with fiat currency, and earn interest as a lender. The difference is that DeFi apps operate "without a central service exercising control over the entire system," said John Wu, president of Ava Labs, a team supporting development of DeFi applications on the Avalanche blockchain.

"People have been participating in DeFi without understanding the risks."ĭeFi applications aim to recreate traditional financial systems, such as banks and exchanges, with cryptocurrency.

"I think it's really important for people participating in the DeFi space to understand the risks and rewards," Meltem Demirors, CoinShares chief strategy officer, told CNBC Make It. DeFi fraudsters stole an additional $83.4 million.Īnd although it's rare for coins to completely tank, like with titan, it's still possible, and investors should be aware. His takeaway: "Do your own research," he told CNBC Make It.įraud within the space has recently surged between January and April, $156 million was stolen in DeFi-related hacks, according to CipherTrace. Regardless, Cuban's experience is a good reminder of how volatile and risky investing in crypto, and DeFi especially, can be. The project said in a blog post that the crash was due to a "bank run," or panic selling, and the token's algorithmic code. "I got hit like everyone else," Cuban, owner of the Dallas Mavericks and an investor on ABC's "Shark Tank," tweeted on Wednesday.Īt first, some in the crypto world speculated that this was the result of a rug pull, which is a type of scam where developers abandon a project and leave with investors' funds.

0 kommentar(er)

0 kommentar(er)